The Federal Emergency Management Agency (FEMA) has updated the National Flood Insurance Program (NFIP) with a new risk rating methodology, Risk Rating 2.0. The new program will change the way flood insurance rates are calculated and how customers are charged.

“Some homeowners will absorb the increase as the price you pay for living in a coastal area, while the new prices will be significant for other homeowners,” says Dustyn Shroff, Vice President of GreatFlorida Insurance.

The new program for Risk Rating 2.0 will be implemented in two stages, starting on Oct. 1, 2021, with Phase I. In this phase, new policies will be subject to the new rating system and existing policyholders eligible for renewal will have the “advantage of immediate decreases in their premiums.”

Phase II will take effect on April 1, 2022 when any remaining policies that need to be renewed on or after the date will be subject to the new rating method.

In Florida, FEMA says 1,727,900 policies are currently in effect.

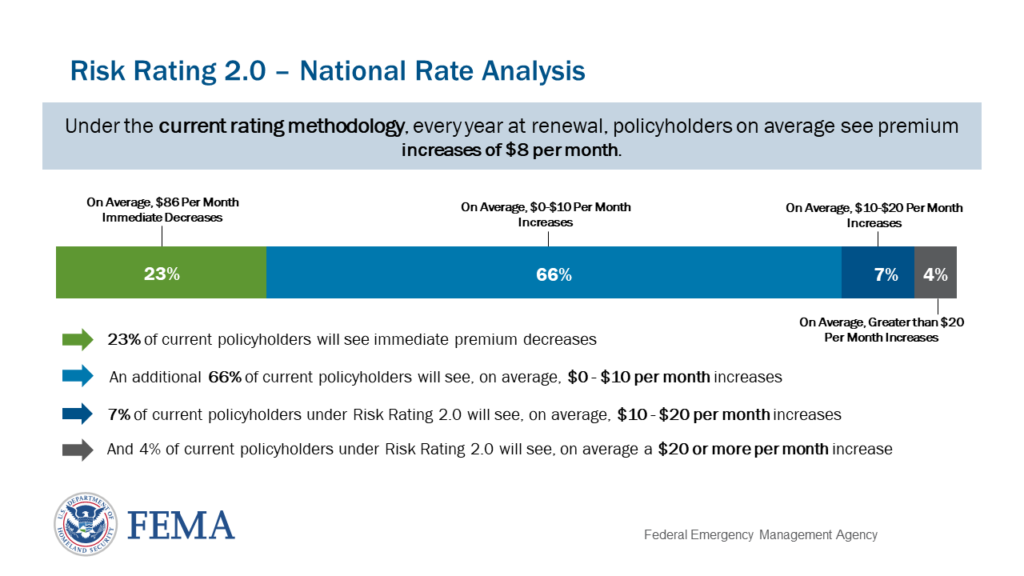

About a quarter of participants will see a decrease in premiums, but most will experience a rise in cost, for some as high as 18 percent annually. Some Florida residents could save as much as $100 a month in some cases. However, the same no longer applies to those now considered to live in higher-risk areas.

FEMA reports 20 percent or 342,142 policies will see an immediate decrease. While 68 percent or 1,178,074 policies will increase $60 to $120 per year. A much smaller group of eight percent or 134,572 policyholders will see a $120 to $240 yearly price hike, while just four percent or 73,113 policies in the state will see a $240 per year or higher increase.

Described as “equity in action,” Risk Rating 2.0 is expected to make it so individuals no longer have to pay more than what FEMA calls “their share” in flood insurance premiums. According to FEMA, about two-thirds of current policyholders with pre-Flood Insurance Rate Map homes will see their premiums go down when the first phase of the policy changes.

Each state has an NFIP risk rating profile and policy analysis on FEMA’s website.

“Premiums are ultimately driven by variables that an individual policyholder controls. Upon receipt of a premium, a policyholder can change the parameters (such as the level of coverage limits, deductibles, and other additional data or take a mitigation action) that impact their properties unique rate,” FEMA said in a Florida rate profile. “This is the same process that exists today under the current methodology.”

Flood Insurance Rate Maps will still be needed for mandatory insurance purchases and floodplain management, even with Risk Rating 2.0. FEMA said the flood map data informs the catastrophe models used to develop the rates, making critical flood mapping data necessary and essential for communities with flood risks

According to FEMA, in Florida, 5.9 million properties are not covered by NFIP. If you need flood insurance, do not wait until it is too late. Contact GreatFlorida Insurance today for questions about a flood insurance policy.